The Milestone of Milestones in Longship

The very first CO2 volumes from the Longship project have now been injected into the Aurora reservoir, 2600 meters beneath the seabed in the North Sea.

On 17 June, Longship was formally put into operation. The occasion was marked through an international conference in Oslo and the opening of the CO2 capture plant in Brevik. This signalled that the world’s first complete CCS value chain is now operational.

CO2 is safely stored

Today Northern Lights reports the first volumes in the permanent storage site beneath the North Sea seabed. – (…) We now injected and stored the very first CO2 safely in the reservoir. Our ships, facilities and wells are now in operation, says Tim Heijn, Managing Director of Northern Lights.

Gassnova follows up Longship on behalf of the Norwegian state. This includes monitoring progress, risks and milestones with the industry partners in the project. – Today’s event in the North Sea must be called the milestone of milestones in Longship. It is an important recognition of the industry partners’ efforts throughout all phases of this project. Gassnova congratulates Northern Lights, Heidelberg Materials and Hafslund Celsio on what is a decisive success factor for Longship, says Thomas Skadal, CEO of Gassnova.

One of Norway’s Most Important Industrial Climate Initiatives

On Tuesday 17 June 2025, the largest climate initiative in the nation’s industrial history was inaugurated. Longship is Norway’s full-scale venture into the capture, transport, and storage of CO2 (CCS).

Longship is a national investment with global significance – demonstrating how government, industry, and the research community can work together to realise future solutions.

From Vision to Reality

Longship’s story is deeply tied to the development of Gassnova. This year marks twenty years since Gassnova was established as the state’s enterprise for CO2 management, founded in response to an energy supply crisis, the gas-fired power plants at Kårstø and Mongstad, and growing concern over their emissions. There was also a growing recognition that continued fossil energy use without carbon capture would be incompatible with international climate obligations.

Gassnova was given a clear mandate: to develop, demonstrate and mature CCS technology to reduce costs and risks, allowing private actors to take the lead in the future. For years, Gassnova and the Research Council of Norway supported technological development through the CLIMIT programme, closely monitoring both national and international pilot projects. Yet one thing was missing: a full-scale demonstration facility covering the entire value chain from capture to storage. With Longship, that missing piece became a reality.

Within the Longship project, Gassnova represents the government’s interests during planning, construction and operations. The enterprise also holds an additional responsibility: to ensure lessons from the project are shared widely. Together with the Ministry of Energy and the industrial partners, Gassnova’s efforts have helped make Longship an international reference project for CCS.

The development of CCS technologies also has a strong foundation at Mongstad. The Technology Centre Mongstad (TCM) is one of the world’s leading CO2 capture test facilities. TCM was established with support from the Norwegian state, Equinor, Shell and TotalEnergies. For more than a decade, the centre has delivered crucial insight into efficiency, safety, and cost drivers in the capture process. These insights were a key part of the technology choices made in Longship.

The Parliamentary Decision

In 2021, the Norwegian Parliament voted to finance Longship with broad political support. It was clear that the state would need to shoulder a substantial share of the cost. This was not just a technological undertaking—it was a strategically important climate measure.

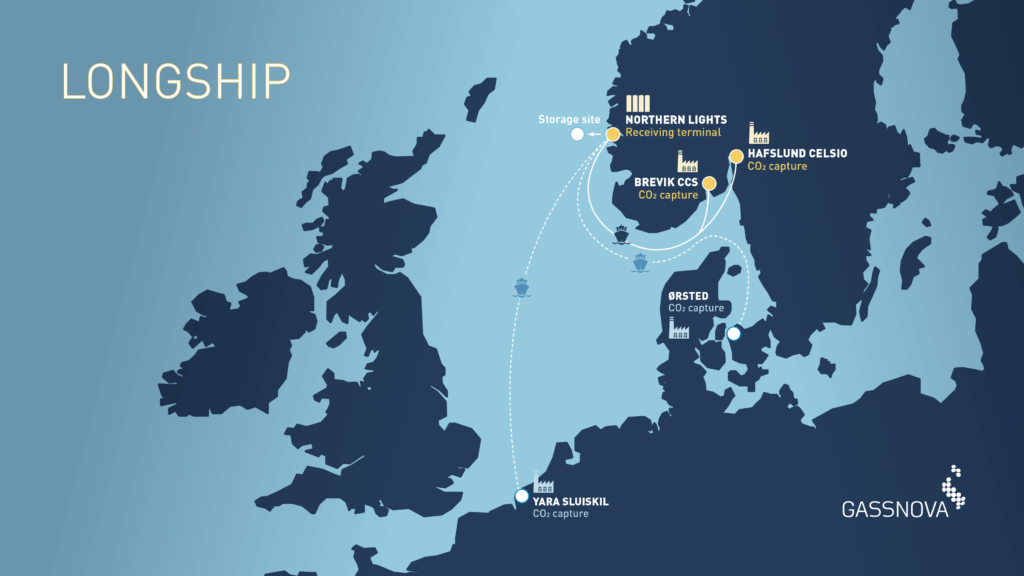

Longship was structured as a value chain comprising three main elements: Brevik CCS, operated by Heidelberg Materials; Oslo CCS, led by Hafslund Celsio; and Northern Lights, a joint transport and storage company established by Equinor, Shell, and TotalEnergies. The state entered into separate agreements with Heidelberg Materials and the Northern Lights joint venture for investment and operations. Oslo CCS received its support later in the process.

Three Major Projects

The Northern Lights project has been a breakthrough. In Øygarden, a fully developed reception terminal with port infrastructure and CO2 tanks has been completed. It will receive liquid CO2 from the capture plants and inject it into subsea reservoirs beneath the North Sea. With Northern Lights, the infrastructure is in place for future growth and for exporting CO2 storage services to Europe. Recently, the Ministry of Energy approved Phase 2 of the project, which will increase the transport and storage capacity from 1.5 million to at least 5 million tonnes of CO2 per year. This phase involves expanding the onshore facilities at Øygarden and increasing the number of offshore injection wells from two to four.

In Brevik, Heidelberg Materials has built the world’s first carbon capture plant at an operating cement facility. It will capture 400,000 tonnes of CO2 annually from cement production. The plant is fully integrated into the daily operations of the factory and provides valuable knowledge on safety, energy optimisation, and full-scale operations.

Oslo CCS plans to capture 400,000 tonnes of CO2 annually from the waste-to-energy plant at Klemetsrud. This project sends an important signal to major cities around the world: that even urban emission sources can eliminate their CO2 and contribute to net-zero targets. All three projects have faced different technical and financial challenges. That is, in fact, the essence of a demonstration project. Risks must be identified, addressed and reduced so that future players will face lower thresholds for investing in CCS.

Collaboration Makes Longship Possible

Longship is defined by a close and structured collaboration between industry, government, and academia—a typically Norwegian model that has proven resilient in climate work. Industry’s willingness to invest, the state’s capacity to provide support, and the role of researchers in analysing and documenting the process are the cornerstones of Longship. In addition, Norway’s highly skilled technology environments have followed the project closely with a research-oriented focus.

Longship as a Global Learning Arena

Longship is more than a Norwegian industrial project. It is a demonstration project for the world. For Europe, it is a real climate project that enables emissions cuts in heavy industry. This makes Longship unique.

Combined with the test results and experience from TCM, Norway has developed a CCS value chain that is not only operational but also exportable. Together, Longship and TCM represent a unique platform for further international learning and cooperation.

From a global perspective, Longship demonstrates that CCS is a real and available climate measure. Reducing emissions in heavy industry, energy, and waste incineration cannot be solved through electrification or hydrogen alone. CCS will be an essential part of the climate toolbox – and Longship proves that it is achievable.

Gassnova has published a number of technical and regulatory learning reports. These reports are open and accessible to all future CCS projects, both in Norway and internationally.

What Now?

Longship is operational. The real work can begin. Several European industrial companies have already signed agreements with Northern Lights to deliver CO2 to the Øygarden terminal. With advantages in geology, technology and political experience, Norway is now playing a global role in the development of CO2 storage – just as it once did in the development of oil and gas in the 1970s.

Longship is more than a project. It is a roadmap. It is the proof that industrialised countries can take climate commitments seriously without dismantling their own industries. With Longship, Norway takes on an important role in helping the world reach its climate goals. According to the UN Intergovernmental Panel on Climate Change, CCS projects like Longship are essential for achieving global emission reductions.

The Longship has set sail.

New CEO of Gassnova

Thomas Skadal (54) has been appointed as the new CEO of Gassnova SF.

Thomas Skadal joins from his position as CEO of Biozin Holding, which he has led for nearly seven years. Prior to this, Thomas held various positions at ExxonMobil, both nationally and internationally, over a span of 20 years.

Experienced leader from the energy sector

– We are very pleased to have Thomas on board. He brings extensive experience from the energy sector, with a background in environments closely aligned with Gassnova’s areas of operation. Thomas is also the kind of leader who can guide the knowledge-based organization Gassnova in the direction we envision. We are entering a very exciting phase of development for the company and a crucial period for CCS, says Trond Moengen, Chairman of the Board at Gassnova SF.

Before joining Biozin Holding AS, Thomas had a long career at ExxonMobil, holding various leadership positions both in Norway and internationally. His experience spans from refinery operations to international trading and business development.

At Biozin Holding, Thomas led the company through an extensive development phase, where the Biozin project in Åmli became the first Norwegian project to receive funding from the EU Innovation Fund. He also played a key role in negotiations when Equinor joined as a new partner in the company in 2023.

Combined with a master’s degree in finance from the Norwegian School of Economics and a background in the Armed Forces, Thomas Skadal possesses strong professional and strategic expertise that Gassnova will benefit from in the years ahead.

Close and strong collaboration

Thomas looks forward to starting at Gassnova on May 1st. – Taking on this leadership role allows me to become part of a highly competent knowledge environment for CO2 management, also on a global scale. This provides the best foundation for the launch of the Longship project, in close collaboration with industry players and in alignment with the expectations of the Ministry of Energy. I look forward to working closely with the board, the ministry, and the employees as we continue to develop Gassnova together.

Thomas Skadal replaces Morten Henriksen, who has chosen to pursue new opportunities outside the company.

Morten Henriksen steps down as CEO of Gassnova

Morten Henriksen has resigned as CEO of Gassnova.

The resignation is due to family circumstances and a commuting situation that has become too difficult. Morten has therefore decided to prioritise his family.

“Morten has done a very good job at Gassnova during his time here. The Board greatly appreciates the work Morten has done and believes that the company is developing well and is well equipped to play an important role in the further development and deployment of CCS in Norway. We are also pleased that Morten, together with the rest of management and the board, will continue the good work until his departure,” says Chairman Trond Moengen.

The Board is now starting the recruitment process with the aim of having a new CEO in place at Gassnova when Morten is due to step down in March 2025.

CO₂ Breaks Boundaries in Europe

On Monday, April 15th, Norway, Belgium, the Netherlands, Denmark, and Sweden signed a Memorandum of Understanding (MoU) concerning the cross-border transport of CO2 for storage.

This MoU will legalize the transnational shipment of CO2 for storage within the territories of the involved countries. Previously, cross-border transport of CO2 for storage was not permitted. Reversing this is critically important in the development of the Longship project.

– We have always had strong believe in Norway, Belgium, the Netherlands, Denmark, and Sweden would reach an agreement on CO2 transport for storage, regardless of the borders between the countries. With this, another barrier has been cleared, allowing CO2 to find its way to the storage facilities on the Norwegian shelf. This also highlights the importance of Longship as a demonstration project and the renewed interest in CO2 management as a climate solution in Europe – says Aslak Viumdal, senior advisor at Gassnova and responsible for benefits realization in the Longship project.

In a statement from the Norwegian Ministry of Energy, Minister Terje Aasland emphasizes the agreement as important for the climate, Norway’s attention to the energy sector, and the country’s focus on CCS.

Green Project Classification and Green Reporting

The Ministry of Trade, Industry and Fisheries (NFD) has initiated a project to promote green growth and sustainable development, known as Green Project Classification and Green Reporting.

A proposal for how the project can be implemented has been prepared in collaboration between a number of key actors within the Norwegian policy instrument framework – Innovation Norway, the Research Council of Norway, Siva, Eksfin, DOGA, Enova and Gassnova.

The policy instrument actors have committed to the work of classifying and reporting on green projects. This effort is not only a response to the government’s mandate but also an expansion of the existing cooperation to promote green growth. Through close dialogue with the NFD, which acts as a coordinator among relevant departments, it is ensured that the project is developed in harmony with the overarching goals for the environment and climate.

Three ministries are central

Ministries such as the Ministry of Climate and Environment (KLD), the Ministry of Education and Research (KD), and the Ministry of Energy (ED) play key roles in this process – through their ownership and management of respective entities such as Enova, the Research Council and Gassnova.

Starting this year, the actors will implement a classification of projects assumed to have a positive effect on climate and the environment, based on six environmental categories. This includes a commitment to develop a guide for green project classification and reporting, which will facilitate case handling and ensure involvement of relevant departments in an appropriate manner.

The further development of the reporting solution will also focus on the “do no significant harm” principle, which lays the groundwork for a differentiated assessment of the projects. There is a push for a dynamic development of the reporting system, which can be adjusted based on experiences and general development within the field.

Norway takes the lead

In a time when climate change poses one of the greatest challenges for global sustainability, Norway takes the lead with this new initiative. The core is to promote sustainable growth through a systematic approach to project categorization based on environmental impact. By providing detailed statistical data and clear guidance for environmental categorization, the aim is to enhance project developers’ ability to carry out measures that are both innovative and environmentally friendly. This occurs in line with the EU taxonomy for sustainable economic activity – ensuring Norwegian projects to meet not only local but also international sustainability standards.

Challenges and solutions

One of the biggest challenges in the implementation of green project classification is the complexity related to evaluating projects’ environmental impact. Therefore, simplified assessment criteria are proposed balancing the need for thorough environmental assessments against the feasibility of the projects. This will ease the burden on project developers while simultaneously improving the availability and quality of environmental data for the public and decision-makers.

A differentiated system ensures that projects of various scales and nature can meet sustainability requirements without being overwhelmed by the complexity of reporting requirements.

The way forward

To ensure that progress and experiences are shared, the policy instrument actors will report to the NFD by the end of May this year, with a status update on the implementation of classification and reporting. This will be followed by an evaluation to measure the effectiveness and impact of the measures, forming the basis for decisions and adjustments in the work going forward.

Germany; Climate targets will be challenging without CO₂ management

In the face of Germany’s ambitious goal to become carbon neutral by 2045, the country faces challenges. CCS and CCU will be key solutions, in accordance with the German government’s proposal for a CO2 management strategy.

Germany’s Federal Minister for Economic Affairs and Climate Action Dr. Robert Habeck is proposing political measures to carbon capture and storage (CCS) and carbon capture and utilisation (CCU) technologies can be utilised in the future. This is according to a proposal issued by the Bundesministerium für Wirtschaft und Klimaschinistry on Monday 26 February. Habeck’s view is conveyed through a CO2 management strategy. Together with a proposal to amend the law on CO2 storage. This complements today’s other climate measures and will enable Germany to meet its climate targets and the EU’s recently proposed 2040 target.

An all-encompassing plan

Germany’s climate plan is not limited to the implementation of CCS and CCU, on the contrary, Germany is facilitating a range of other measures. Germany has a comprehensive plan that includes developing renewable energy, developing a hydrogen economy, phasing out fossil fuels, improving energy efficiency and promoting the circular economy.

Germany in close dialogue with Norway

In recent years, German government officials, public bodies and companies have made several study tours to Norway. Therfore to learn from the experience of developing the Longship project. Gassnova, among others, has contributed with planning and technical input. In 2022, Habeck visited Heidelberg Materials’ cement plant in Brevik, which is one of the key players in the Langskip project.

Without compromising industrial competitiveness

The German initiative is an important step towards tackling industrial CO2 emissions. That are difficult or impossible to avoid. The strategic focus on CCS and CCU for industrial processes, such as cement production and waste incineration. By capturing and storing CO2. Germany can move closer to its goal of climate neutrality without sacrificing industrial capacity or competitiveness.

Germany’s plan emphasises responsibility for the environment and promotes technological solutions. By excluding marine protected areas from offshore storage of CO2. Germany is taking a stand to balance industrial needs with its marine considerations. The measure signals a willingness to protect the climate and to set strict requirements for the use of climate measures. These include ensuring that CO2 can only be stored in geologically suitable areas without the risk of leakage or damage. It also allows for the cross-border transport of CO2 for permanent storage, reflecting both Germany’s limited storage capacity and the fact that the country is looking beyond its own borders for storage solutions.

Life cycle analyses assess the climate footprint of projects

Life Cycle Assessment (LCA) is a systematic approach to documenting environmental and resource impacts throughout the life of a product or service.

LCA enables decision-makers in industry and other sectors to assess the environmental and climate footprint of products and services before they are used or implemented.

Further LCA can also be used to assess the environmental and resource efficiency of different ways of managing waste resources and emissions such as CO2. It also plays a key role in assessing whether a value chain can be considered carbon neutral or whether it contributes to carbon removal (CDR).

Need for harmonisation of LCA

“The literature clearly shows that there is a need for international harmonisation of LCA. In the field of carbon capture, use and storage. This is particularly true for the documentation of avoided and negative emissions. And the choice of system boundaries. The choice between extended system boundaries and the distribution of burdens and benefits among different actors in the value chain requires careful consideration. Both approaches have advantages and disadvantages”, says Hanne Lerche Raadal from the Norwegian Institute for Sustainability Research (NORSUS. Adding that “physical equalisation or mass balancing is also an important issue”.

LCA methods are an important focus of the international Mission Innovation Carbon Dioxide Removal (MI CDR) collaboration. Launched by Barak Obama during the UN Climate Change Conference in Paris 2015 (COP21). Mission Innovation is an international ministerial-level collaboration. The CDR mission was launched by Mission Innovation at COP 26. The Ministry of Energy is responsible for Norway’s participation in Mission Innovation. Gassnova continues this work on behalf of the Ministry of Energy.

LCA project with link to Mission Innovation

In January this year, NORSUS and its partners received funding from CLIMIT-Demo for the project: “Development of LCA methodology for documentation of negative emissions and allocation of burdens and benefits in CCUS value chains“. “The project will be an important Norwegian contribution to the LCA work of Mission Innovation CDR. Where Norway and Japan (METI) are leading the CDR within Biomass and Storage (BiCRS)”, says Senior Advisor at Gassnova, Jørild Svalestuen. To ensure broad experience and professional insight. Therefor the project includes a reference group of international LCA experts who will follow and contribute to the work.

NORSUS is one of Europe’s leading LCA research centres. For several decades they have been working with circular economy and the mapping of environmental and resource efficiency using LCA.

The project has solid industrial partners represented by Borregaard AS, Carbon Centric AS, FREVAR KF, Hafslund Oslo Celsio AS, Heidelberg Materials Sement Norge AS, Returkraft AS and Statkraft Varme AS.

EU target proposals for 2040 call for effort

The European Commission ‘s strategy to capture, store and use CO2 and meet the 2040 targets in a sustainable way requires action from European industry.

New targets from the European Commision

The European Commision has committed to a target of ‘net zero’CO2 emissions by 2050. This will require a significant reduction in emissions in the coming years. In addition to the development and implementation of technologies for the capture and storage or use of CO2. This is particularly targeted at sectors where reducing CO2 emissions is difficult or costly.

European Commission has presented a strategy on industrial carbon management. The strategy will be important for how different CO2 management solutions (CCS, CCU and CDR) can contribute to reducing CO2 emissions in the EU. And achieving climate neutrality by 2050. “The EU is proposing that government and industry strengthen their cooperation on carbon management,” says Aslak Viumdal, Senior Advisor, Strategy and Business Development at Gassnova.

Increased CO2 Storage Capacity

In the “Net-Zero Industry Act“, the European Commission has decided, among other things, to require oil and gas producers in the EU. To develop at least 50 million tonnes of CO2storage capacity per year by 2030. Based on the recommended EU climate target for 2040. This capacity will need to increase significantly in the future.

The EU’s approach to industrial CO2 management involves a series of measures. This will enable rollout of technology and infrastructure to establish a common market for CO2 in Europe in the coming years. As part of the strategy. The European Commission will prepare for possible regulation of transport and storage services for CO2. This could potentially cover areas such as market and cost structures, third-party access, standards for CO2 quality. And investment incentives for new infrastructure.

The EU Commission’s Joint Research Centre (JRC) in addition published a report on the future CO2 transport network in Europe, and related investment needs.

Storage Atlas suggested by the European Commision

To help scale up the CCS market, the European Commission will develop guidelines for project permitting and an atlas of potential storage sites in Europe. It will also work with Member States to develop a platform to map and aggregate demand for CO2 infrastructure services. This will be matched with transport and storage operators or CO2 receivers. The Commission aims to establish a carbon account with a clear framework for the use of captured CO2 as a resource for sustainable industry.

Incentivews

To create a solid foundation for a CO2 value chain within the EU, the Commission is considering several incentives:

- Investment and financing: The EU and Member States will support industrial carbon capture projects through their energy infrastructure programmes. The Commission is considering whether some carbon capture projects can already be supported by market-based financing mechanisms, such as the Innovation Fund.

- Research, innovation and awareness-raising: The Commission is considering increasing funding for research and innovation on industrial CCS through existing programmes. In particular, Horizon Europe and the Innovation Fund. The Commission also supports the establishment of a knowledge exchange platform on carbon capture, utilisation and storage (CCUS).

- International cooperation: The Commission intends to strengthen international cooperation with partners involved in industrial carbon management. This applies to the reporting and accounting of carbon management activities. This will help to ensure that international carbon pricing frameworks consider sectors where carbon capture and storage is particularly challenging.

CCS Environmental Analysis, November

On a monthly basis, Gassnova prepares an analysis of important CCS international market trends, and what drives innovation in our focus areas. Here is the analysis for November.

COP26: Where do we go from here and what might this mean for the EU’s climate efforts?

Many have expressed disappointment with the results of COP26, among them UN Secretary-General Guterres. He believes that it is time to go ‘into emergency mode’ over the climate crisis.

Failure to live up to promised climate support

The final battle in the negotiations was over the wording on phasing out coal, with some emerging economies such as China and India wanting to tone it down. Developed nations in particular expressed disappointment with this outcome. Many have pointed to the correlation between coal as the way for developing nations to affordably meet their energy needs, and the failure of developed nations to live up to their promised climate support for developing nations embodied in the Paris Agreement. The issue around the $100 billion annual climate finance was also thought to be an underlying cause of tensions during the final negotiations.

A change in focus for upcoming climate negotiations?

Carnegie, an international think tank for global peace, points out that the situation which has unfolded might lead to a change in focus for upcoming climate negotiations – more concerned with climate justice and less with concrete actions. Carnegie also points out that the situation which has emerged will increase the pressure for everyone to achieve their own climate goals. At the same time, it will increase pressure on the EU and other developed nations to fulfil their obligations on climate finance. If it does not, writes Carnegie, the EU may succumb to economic breakdown of supply chains and migratory pressures resulting from climate disruptions. If the EU wants to be a constructive leader on the climate going forward, it has been pointed out that it will be crucial to focus on climate justice, rebuilding the trust of climate vulnerable nations and reducing international tensions in the run up to COP27.

The EU Innovation Fund: €1 billion invested across seven projects – including four CCS projects

After almost eighteen months of competition and 311 submissions with €1 billion up for grabs, seven projects emerged victorious in November. This was the first of several announcements from the Innovation Fund up to 2030 – expected to add up to €25 billion collectively.

Should contribute to significant reductions in emissions up to 2050

The supported projects must be particularly innovative and act as major contributions to significant reductions in emissions up to 2050. The Fund aims to support a wide range of technologies, industries and geographical locations in the EU. The projects selected this time around had profiles in industries regarded as ‘hard-to-abate’, and where the project itself will result in significant reductions in emissions.

4/7 projects incorporate CCS as a part of their solutions

6 out of 7 projects feature a large element of renewable energy or a transition from fossil to renewable energy. 4 out of 7 incorporate CCS as a part of their solution. 5 out of 7 were based in Northern and Western Europe, with none in Central and Eastern Europe. 3 of the projects include elements on the production/use of hydrogen, such as the Swedish HYBRIT project using green hydrogen for steel production. One project involves capturing biogenic CO2 (CCU) from waste for use in chemicals and biofuels. Announcement no. 2 from the Fund is ongoing, with a €1.5 billion pot.

IEA cautiously optimistic about the development of CCS

In November, the IEA’s Head of CCUS provided some general reflections as to why CCS has largely failed to be seen as an important climate initiative in the past, and what will be important for it going forward. The IEA outlines three important conditions behind their optimism for the future development of CCS.

Three conditions behind the IEA’s optimism for the development of CCS

- projects are now concentrated around industrial hubs with shared infrastructure for transport and storage

- more robust public financing schemes are available creating greater predictability for operators

- and tougher and more binding climate policies have been adopted. The IEA is cautious about claiming this will guarantee the success of the well over 100 projects that are currently being planned. Even if all the projects currently being planned are realised (something the IEA itself does not believe will happen), the combined capacity of these projects in 2030 will only constitute about 10% of what the IEA believes is necessary to be on track to reach net-zero by 2050.

Imperial College: The value of CCS will fall with increasing competition from renewable energy

An analysis carried out by Imperial College and published in a scientific paper in November concludes that the societal value of CCS will fall in the future due to increasing competition from renewable energy.

Historic reductions in the cost of renewable energy are greater than predicted

Essential to understanding the results of the analysis is the emphasis it places on the historic cost reductions in renewable energy (wind/solar + battery) being greater than predicted in most of the analysis models (‘integrated assessment model’) that are used internationally. That the IEA and others have systematically underestimated the reduction in cost of renewable energy in trend projection analyses matches with a range of experiences in the sector.

However, the conclusions drawn in the article are easy to understand

The value of CCS is more stable when it is employed in areas that are less exposed to competition from renewable energy – such as from process-related emissions (i.e. cement works) and carbon negative solutions (BECCS and DACCS). ‘Value’ here means the marginal reduction of societal costs provided by a climate initiative compared with not adopting the initiative. The value of CCS is less stable when CCS is used in combination with fossil fuel-based energy as it is in direct competition with renewable energy – such as gas power with CCS and blue hydrogen production. In these areas, the value of CCS is reduced by between 61% and 96% compared with what the authors believe to be more normal assumptions about the cost development of renewable energy.

The EU’s hydrogen strategy is materialising; €2 billion for the EU Clean Hydrogen Partnership

At the end of November, the President of the European Commission announced a new initiative to foster research and innovation in hydrogen through a public-private partnership with both parties providing €1 billion each.

Will reduce the cost of green hydrogen down to less than €2 per kg H2 in 2030

European priorities will be adjusted with this new venture, focussing less on hydrogen-powered private vehicles and more on green hydrogen and use in the processing industry. The goal of this is to reduce the cost of green hydrogen down to less than €2 per kg H2 in 2030. Under more normal energy prices than those we are seeing in the EU today, hydrogen from natural gas would cost about €2 per kg. With current gas and energy prices, the situation is drastically different and means the cost of hydrogen has become much higher, irrespective of the production method. Uncertainty relating to future gas prices and the desire to phase-out the use of fossil fuel-based energy are factors forming the basis of the EU’s focus on green hydrogen.

Head of the IEA surprised by this focus

The head of the IEA, for his part, was somewhat surprised by this focus, because he believed that the market was not mature enough to warrant such a large focus, and was surprised that the EU would devote so many resources to something that would mostly benefit other nations (such as China). In this context, he refers to other examples of the same thing happening for Europe.

Carbon Dioxide Removal (CDR); From distraction to prerequisite for achieving climate goals

Those who have been following the international debate over CCS in the last few years will probably have noticed the clear-cut fronts between the different camps for CCS, CCU and CDR.

From being expensive and dangerous, to being warmly welcomed

As usual, the viewpoint of the individual, including their basic assumptions, is crucial for the conclusions they arrive at. Over the years, industrial CDR (such as Bio CCS and DACCS) has been warned against as a costly or dangerous ‘distraction’, to becoming increasingly welcomed and is now frequently mentioned as a requirement for achieving climate goals. This is similar to the change in opinion over time around CCS. Before 2020, while the EU’s climate goal was an 80-95% reduction in greenhouse gasses by 2050 compared to 1990, there were many industrial organisations that strongly believed that CCS would not be needed before 2050. But since an ever increasing share of the global economy is now subject to a goal of net-zero emissions (now: 80%), the public discourse has changed dramatically in a short space of time – on CCS, CCU and CDR. That said, it cannot be guaranteed that any industrial CDR will be fit for purpose. The laws of physics, limited natural resources and the need to be profitable will continue to limit what can be realistically achieved.

The strategy under development could include a goal of 5Mt CO2 stored each year through industrial CDR

One important development worthy of mention is the EU strategy currently in preparation which could include a goal of 5Mt CO2 stored each year through industrial CDR. During COP26 in November, the USA announced an initiative to remove 1 Gt CO2 from the atmosphere (CDR) at a cost of less than $100/tonne by 2050. And in November the Swedish Energy Agency delivered its recommendation to the Swedish government of a support system to remove up to 2 million tonnes of CO2 per year fro the atmosphere through Bio CCS by 2030.

In November, the IEA released its updated assessment on the status of DACCS and also recently published an article with recommendations as to how member nations could realise the potential BECCS represents. In their ‘Net Zero 2050’ scenario, the IEA says of DACCS that close to 90 Mt CO2 per year will need to be extracted by 2030. According to the IEA, one of the steps that public authorities can take to promote a market for CDR is to buy CO2 reductions directly from businesses offering it.

The Environmental Analysis is prepared by Gassnova’s analysis team.