CCS Environmental Analysis, November

On a monthly basis, Gassnova prepares an analysis of important CCS international market trends, and what drives innovation in our focus areas. Here is the analysis for November.

COP26: Where do we go from here and what might this mean for the EU’s climate efforts?

Many have expressed disappointment with the results of COP26, among them UN Secretary-General Guterres. He believes that it is time to go ‘into emergency mode’ over the climate crisis.

Failure to live up to promised climate support

The final battle in the negotiations was over the wording on phasing out coal, with some emerging economies such as China and India wanting to tone it down. Developed nations in particular expressed disappointment with this outcome. Many have pointed to the correlation between coal as the way for developing nations to affordably meet their energy needs, and the failure of developed nations to live up to their promised climate support for developing nations embodied in the Paris Agreement. The issue around the $100 billion annual climate finance was also thought to be an underlying cause of tensions during the final negotiations.

A change in focus for upcoming climate negotiations?

Carnegie, an international think tank for global peace, points out that the situation which has unfolded might lead to a change in focus for upcoming climate negotiations – more concerned with climate justice and less with concrete actions. Carnegie also points out that the situation which has emerged will increase the pressure for everyone to achieve their own climate goals. At the same time, it will increase pressure on the EU and other developed nations to fulfil their obligations on climate finance. If it does not, writes Carnegie, the EU may succumb to economic breakdown of supply chains and migratory pressures resulting from climate disruptions. If the EU wants to be a constructive leader on the climate going forward, it has been pointed out that it will be crucial to focus on climate justice, rebuilding the trust of climate vulnerable nations and reducing international tensions in the run up to COP27.

The EU Innovation Fund: €1 billion invested across seven projects – including four CCS projects

After almost eighteen months of competition and 311 submissions with €1 billion up for grabs, seven projects emerged victorious in November. This was the first of several announcements from the Innovation Fund up to 2030 – expected to add up to €25 billion collectively.

Should contribute to significant reductions in emissions up to 2050

The supported projects must be particularly innovative and act as major contributions to significant reductions in emissions up to 2050. The Fund aims to support a wide range of technologies, industries and geographical locations in the EU. The projects selected this time around had profiles in industries regarded as ‘hard-to-abate’, and where the project itself will result in significant reductions in emissions.

4/7 projects incorporate CCS as a part of their solutions

6 out of 7 projects feature a large element of renewable energy or a transition from fossil to renewable energy. 4 out of 7 incorporate CCS as a part of their solution. 5 out of 7 were based in Northern and Western Europe, with none in Central and Eastern Europe. 3 of the projects include elements on the production/use of hydrogen, such as the Swedish HYBRIT project using green hydrogen for steel production. One project involves capturing biogenic CO2 (CCU) from waste for use in chemicals and biofuels. Announcement no. 2 from the Fund is ongoing, with a €1.5 billion pot.

IEA cautiously optimistic about the development of CCS

In November, the IEA’s Head of CCUS provided some general reflections as to why CCS has largely failed to be seen as an important climate initiative in the past, and what will be important for it going forward. The IEA outlines three important conditions behind their optimism for the future development of CCS.

Three conditions behind the IEA’s optimism for the development of CCS

- projects are now concentrated around industrial hubs with shared infrastructure for transport and storage

- more robust public financing schemes are available creating greater predictability for operators

- and tougher and more binding climate policies have been adopted. The IEA is cautious about claiming this will guarantee the success of the well over 100 projects that are currently being planned. Even if all the projects currently being planned are realised (something the IEA itself does not believe will happen), the combined capacity of these projects in 2030 will only constitute about 10% of what the IEA believes is necessary to be on track to reach net-zero by 2050.

Imperial College: The value of CCS will fall with increasing competition from renewable energy

An analysis carried out by Imperial College and published in a scientific paper in November concludes that the societal value of CCS will fall in the future due to increasing competition from renewable energy.

Historic reductions in the cost of renewable energy are greater than predicted

Essential to understanding the results of the analysis is the emphasis it places on the historic cost reductions in renewable energy (wind/solar + battery) being greater than predicted in most of the analysis models (‘integrated assessment model’) that are used internationally. That the IEA and others have systematically underestimated the reduction in cost of renewable energy in trend projection analyses matches with a range of experiences in the sector.

However, the conclusions drawn in the article are easy to understand

The value of CCS is more stable when it is employed in areas that are less exposed to competition from renewable energy – such as from process-related emissions (i.e. cement works) and carbon negative solutions (BECCS and DACCS). ‘Value’ here means the marginal reduction of societal costs provided by a climate initiative compared with not adopting the initiative. The value of CCS is less stable when CCS is used in combination with fossil fuel-based energy as it is in direct competition with renewable energy – such as gas power with CCS and blue hydrogen production. In these areas, the value of CCS is reduced by between 61% and 96% compared with what the authors believe to be more normal assumptions about the cost development of renewable energy.

The EU’s hydrogen strategy is materialising; €2 billion for the EU Clean Hydrogen Partnership

At the end of November, the President of the European Commission announced a new initiative to foster research and innovation in hydrogen through a public-private partnership with both parties providing €1 billion each.

Will reduce the cost of green hydrogen down to less than €2 per kg H2 in 2030

European priorities will be adjusted with this new venture, focussing less on hydrogen-powered private vehicles and more on green hydrogen and use in the processing industry. The goal of this is to reduce the cost of green hydrogen down to less than €2 per kg H2 in 2030. Under more normal energy prices than those we are seeing in the EU today, hydrogen from natural gas would cost about €2 per kg. With current gas and energy prices, the situation is drastically different and means the cost of hydrogen has become much higher, irrespective of the production method. Uncertainty relating to future gas prices and the desire to phase-out the use of fossil fuel-based energy are factors forming the basis of the EU’s focus on green hydrogen.

Head of the IEA surprised by this focus

The head of the IEA, for his part, was somewhat surprised by this focus, because he believed that the market was not mature enough to warrant such a large focus, and was surprised that the EU would devote so many resources to something that would mostly benefit other nations (such as China). In this context, he refers to other examples of the same thing happening for Europe.

Carbon Dioxide Removal (CDR); From distraction to prerequisite for achieving climate goals

Those who have been following the international debate over CCS in the last few years will probably have noticed the clear-cut fronts between the different camps for CCS, CCU and CDR.

From being expensive and dangerous, to being warmly welcomed

As usual, the viewpoint of the individual, including their basic assumptions, is crucial for the conclusions they arrive at. Over the years, industrial CDR (such as Bio CCS and DACCS) has been warned against as a costly or dangerous ‘distraction’, to becoming increasingly welcomed and is now frequently mentioned as a requirement for achieving climate goals. This is similar to the change in opinion over time around CCS. Before 2020, while the EU’s climate goal was an 80-95% reduction in greenhouse gasses by 2050 compared to 1990, there were many industrial organisations that strongly believed that CCS would not be needed before 2050. But since an ever increasing share of the global economy is now subject to a goal of net-zero emissions (now: 80%), the public discourse has changed dramatically in a short space of time – on CCS, CCU and CDR. That said, it cannot be guaranteed that any industrial CDR will be fit for purpose. The laws of physics, limited natural resources and the need to be profitable will continue to limit what can be realistically achieved.

The strategy under development could include a goal of 5Mt CO2 stored each year through industrial CDR

One important development worthy of mention is the EU strategy currently in preparation which could include a goal of 5Mt CO2 stored each year through industrial CDR. During COP26 in November, the USA announced an initiative to remove 1 Gt CO2 from the atmosphere (CDR) at a cost of less than $100/tonne by 2050. And in November the Swedish Energy Agency delivered its recommendation to the Swedish government of a support system to remove up to 2 million tonnes of CO2 per year fro the atmosphere through Bio CCS by 2030.

In November, the IEA released its updated assessment on the status of DACCS and also recently published an article with recommendations as to how member nations could realise the potential BECCS represents. In their ‘Net Zero 2050’ scenario, the IEA says of DACCS that close to 90 Mt CO2 per year will need to be extracted by 2030. According to the IEA, one of the steps that public authorities can take to promote a market for CDR is to buy CO2 reductions directly from businesses offering it.

The Environmental Analysis is prepared by Gassnova’s analysis team.

CCS Environmental Analysis, November

On a monthly basis, Gassnova prepares an analysis of important CCS international market trends, and what drives innovation in our focus areas. Here is the analysis for November.

COP26: Where do we go from here and what might this mean for the EU’s climate efforts?

Many have expressed disappointment with the results of COP26, among them UN Secretary-General Guterres. He believes that it is time to go ‘into emergency mode’ over the climate crisis.

Failure to live up to promised climate support

The final battle in the negotiations was over the wording on phasing out coal, with some emerging economies such as China and India wanting to tone it down. Developed nations in particular expressed disappointment with this outcome. Many have pointed to the correlation between coal as the way for developing nations to affordably meet their energy needs, and the failure of developed nations to live up to their promised climate support for developing nations embodied in the Paris Agreement. The issue around the $100 billion annual climate finance was also thought to be an underlying cause of tensions during the final negotiations.

A change in focus for upcoming climate negotiations?

Carnegie, an international think tank for global peace, points out that the situation which has unfolded might lead to a change in focus for upcoming climate negotiations – more concerned with climate justice and less with concrete actions. Carnegie also points out that the situation which has emerged will increase the pressure for everyone to achieve their own climate goals. At the same time, it will increase pressure on the EU and other developed nations to fulfil their obligations on climate finance. If it does not, writes Carnegie, the EU may succumb to economic breakdown of supply chains and migratory pressures resulting from climate disruptions. If the EU wants to be a constructive leader on the climate going forward, it has been pointed out that it will be crucial to focus on climate justice, rebuilding the trust of climate vulnerable nations and reducing international tensions in the run up to COP27.

The EU Innovation Fund: €1 billion invested across seven projects – including four CCS projects

After almost eighteen months of competition and 311 submissions with €1 billion up for grabs, seven projects emerged victorious in November. This was the first of several announcements from the Innovation Fund up to 2030 – expected to add up to €25 billion collectively.

Should contribute to significant reductions in emissions up to 2050

The supported projects must be particularly innovative and act as major contributions to significant reductions in emissions up to 2050. The Fund aims to support a wide range of technologies, industries and geographical locations in the EU. The projects selected this time around had profiles in industries regarded as ‘hard-to-abate’, and where the project itself will result in significant reductions in emissions.

4/7 projects incorporate CCS as a part of their solutions

6 out of 7 projects feature a large element of renewable energy or a transition from fossil to renewable energy. 4 out of 7 incorporate CCS as a part of their solution. 5 out of 7 were based in Northern and Western Europe, with none in Central and Eastern Europe. 3 of the projects include elements on the production/use of hydrogen, such as the Swedish HYBRIT project using green hydrogen for steel production. One project involves capturing biogenic CO2 (CCU) from waste for use in chemicals and biofuels. Announcement no. 2 from the Fund is ongoing, with a €1.5 billion pot.

IEA cautiously optimistic about the development of CCS

In November, the IEA’s Head of CCUS provided some general reflections as to why CCS has largely failed to be seen as an important climate initiative in the past, and what will be important for it going forward. The IEA outlines three important conditions behind their optimism for the future development of CCS.

Three conditions behind the IEA’s optimism for the development of CCS

- projects are now concentrated around industrial hubs with shared infrastructure for transport and storage

- more robust public financing schemes are available creating greater predictability for operators

- and tougher and more binding climate policies have been adopted. The IEA is cautious about claiming this will guarantee the success of the well over 100 projects that are currently being planned. Even if all the projects currently being planned are realised (something the IEA itself does not believe will happen), the combined capacity of these projects in 2030 will only constitute about 10% of what the IEA believes is necessary to be on track to reach net-zero by 2050.

Imperial College: The value of CCS will fall with increasing competition from renewable energy

An analysis carried out by Imperial College and published in a scientific paper in November concludes that the societal value of CCS will fall in the future due to increasing competition from renewable energy.

Historic reductions in the cost of renewable energy are greater than predicted

Essential to understanding the results of the analysis is the emphasis it places on the historic cost reductions in renewable energy (wind/solar + battery) being greater than predicted in most of the analysis models (‘integrated assessment model’) that are used internationally. That the IEA and others have systematically underestimated the reduction in cost of renewable energy in trend projection analyses matches with a range of experiences in the sector.

However, the conclusions drawn in the article are easy to understand

The value of CCS is more stable when it is employed in areas that are less exposed to competition from renewable energy – such as from process-related emissions (i.e. cement works) and carbon negative solutions (BECCS and DACCS). ‘Value’ here means the marginal reduction of societal costs provided by a climate initiative compared with not adopting the initiative. The value of CCS is less stable when CCS is used in combination with fossil fuel-based energy as it is in direct competition with renewable energy – such as gas power with CCS and blue hydrogen production. In these areas, the value of CCS is reduced by between 61% and 96% compared with what the authors believe to be more normal assumptions about the cost development of renewable energy.

The EU’s hydrogen strategy is materialising; €2 billion for the EU Clean Hydrogen Partnership

At the end of November, the President of the European Commission announced a new initiative to foster research and innovation in hydrogen through a public-private partnership with both parties providing €1 billion each.

Will reduce the cost of green hydrogen down to less than €2 per kg H2 in 2030

European priorities will be adjusted with this new venture, focussing less on hydrogen-powered private vehicles and more on green hydrogen and use in the processing industry. The goal of this is to reduce the cost of green hydrogen down to less than €2 per kg H2 in 2030. Under more normal energy prices than those we are seeing in the EU today, hydrogen from natural gas would cost about €2 per kg. With current gas and energy prices, the situation is drastically different and means the cost of hydrogen has become much higher, irrespective of the production method. Uncertainty relating to future gas prices and the desire to phase-out the use of fossil fuel-based energy are factors forming the basis of the EU’s focus on green hydrogen.

Head of the IEA surprised by this focus

The head of the IEA, for his part, was somewhat surprised by this focus, because he believed that the market was not mature enough to warrant such a large focus, and was surprised that the EU would devote so many resources to something that would mostly benefit other nations (such as China). In this context, he refers to other examples of the same thing happening for Europe.

Carbon Dioxide Removal (CDR); From distraction to prerequisite for achieving climate goals

Those who have been following the international debate over CCS in the last few years will probably have noticed the clear-cut fronts between the different camps for CCS, CCU and CDR.

From being expensive and dangerous, to being warmly welcomed

As usual, the viewpoint of the individual, including their basic assumptions, is crucial for the conclusions they arrive at. Over the years, industrial CDR (such as Bio CCS and DACCS) has been warned against as a costly or dangerous ‘distraction’, to becoming increasingly welcomed and is now frequently mentioned as a requirement for achieving climate goals. This is similar to the change in opinion over time around CCS. Before 2020, while the EU’s climate goal was an 80-95% reduction in greenhouse gasses by 2050 compared to 1990, there were many industrial organisations that strongly believed that CCS would not be needed before 2050. But since an ever increasing share of the global economy is now subject to a goal of net-zero emissions (now: 80%), the public discourse has changed dramatically in a short space of time – on CCS, CCU and CDR. That said, it cannot be guaranteed that any industrial CDR will be fit for purpose. The laws of physics, limited natural resources and the need to be profitable will continue to limit what can be realistically achieved.

The strategy under development could include a goal of 5Mt CO2 stored each year through industrial CDR

One important development worthy of mention is the EU strategy currently in preparation which could include a goal of 5Mt CO2 stored each year through industrial CDR. During COP26 in November, the USA announced an initiative to remove 1 Gt CO2 from the atmosphere (CDR) at a cost of less than $100/tonne by 2050. And in November the Swedish Energy Agency delivered its recommendation to the Swedish government of a support system to remove up to 2 million tonnes of CO2 per year fro the atmosphere through Bio CCS by 2030.

In November, the IEA released its updated assessment on the status of DACCS and also recently published an article with recommendations as to how member nations could realise the potential BECCS represents. In their ‘Net Zero 2050’ scenario, the IEA says of DACCS that close to 90 Mt CO2 per year will need to be extracted by 2030. According to the IEA, one of the steps that public authorities can take to promote a market for CDR is to buy CO2 reductions directly from businesses offering it.

The Environmental Analysis is prepared by Gassnova’s analysis team.

CCS Environmental Analysis, August 2021

On a monthly basis, Gassnova prepares an analysis of important CCS international market trends, and what drives innovation in our focus areas. Here is the analysis for August.

IPCC: Little news – but one significant change is worth noting

The publication of the first part of the IPCC’s Sixth Assessment Report (AR6, Working Group 1) in August generated a degree of legitimate interest globally.

Working Group 1 relates to the physical climate system and contains little that was not previously known. It primarily serves to provide a strengthened basis for known conclusions.

The most interesting aspect is perhaps therefore to note that the wording has shifted away from emissions ‘will lead to’ various effects to stating that emissions ‘have led to’ those same effects.

The IPCC will finalise the remaining reports as part of its AR6 work by next year – including a Mitigation Report (March) and the Synthesis Report (August).

UK’s hydrogen strategy proposal launched – including draft consultation on associated business models

August marked the launch of the government’s ‘plan for a world leading hydrogen economy’. The strategy outlines the main ways in which a hydrogen value chain would contribute to meeting the British government’s 6th Carbon Budget (2033-37) and subsequent targets. Hydrogen production may account for up to 1/3 of the country’s energy consumption.

The ambition to achieve 5 GW of production capacity by 2030 (up to 42 TWh/p.a.) remains in place. At present, hydrogen production in the UK is estimated to stand at around 27 TWh/p.a.. After 2030, it is estimated that growth will increase significantly to 250-460 TWh, and may then represent up to 1/3 of the country’s overall energy consumption.

British hydrogen strategy more tangible

The strategy does not set out a distribution between blue and green hydrogen, but it does stipulate a ‘twin track approach’ in which the best aspects of each technology are to be utilised. This means that the choice between ‘green’ and ‘blue’ should balance long-term potential against the necessity of phasing technology in at an early stage – in order to optimise value to the taxpayer over the long-term. A production strategy for hydrogen is due to be published in early 2022. The British hydrogen strategy is more tangible when compared to Europe. It is also approximately equal in terms of ambition when measured by volume (EU: +40 GW green H2 by 2030, Germany total 90-110 TWh H2 by 2030).

Consultation on different business models

Alongside the strategy, there is also a consultation on various mechanisms (business models) for how the government envisions remunerating industry for the additional costs associated with the establishment for hydrogen value chains. It is assumed that this support will be channelled through producers rather than in the consumer sector. The consultation describes various models for how support of this kind might be organised.

A number of support schemes have been established with a focus on investments throughout the value chain, including storage of hydrogen and CCS.

‘Net Zero Hydrogen Fund’ highlighted

In this context, the ‘Net Zero Hydrogen Fund’, which is worth a total of £240 million, particularly emphasises support for investment in hydrogen production facilities. It is assumed that the first contracts for the supply of low-carbon hydrogen will be operational by early 2023. The use of hydrogen is specifically targeted at industries that cannot easily electrify or where the use of CCS will be particularly costly.

Four areas are highlighted: industry, transportation, power generation, and local heating. It is expected that the hydrogen strategy will deliver reductions in emissions totalling 41 Mt CO2e over ten years from 2023 to 2032, and that it will create a hydrogen economy worth £900 million by 2030.

Scientific study casts doubt on climate impact of blue hydrogen

A peer-reviewed scientific report produced by two researchers based at Cornell and Stanford Universities respectively, titled ‘How green is blue hydrogen?’ has made headlines throughout the energy and climate sectors around the world. Based on a life cycle assessment (LCA), the authors draw the conclusion that hydrogen produced from natural gas using CCS has a climate footprint on a par with hydrogen from natural gas without CCS (just 12% fewer emissions of GHG). In short, the reason for this conclusion is that CCS does not have an impact on diffuse methane emissions connected to the production and transportation of natural gas, and that CCS in itself requires increased energy consumption which in turn leads to higher methane emissions. The report has added fuel to what was already a fiery debate on the issue of whether it is really feasible to base the green transition on natural gas and blue hydrogen. In addition to discussion about methane emissions, this debate also touches on the fact that present day CCS technology is unable to achieve 100% capture rates and that we may also become dependent on expensive carbon negative solutions (such as DACCS) if we are to count blue hydrogen as ‘net zero’.

A memo from IEAGHG seeks to address some of the assumptions and figures used by the researchers, including pointing out that there are various opportunities to reduce methane emissions throughout the value chain and that there is new technology on the horizon. For the sake of comparison, the international stakeholder body ‘The Hydrogen Council’ published an LCA analysis earlier this year that showed the climate footprint of blue hydrogen as being dependent on multiple factors, and that in some circumstances it can be almost as low as is the case for green hydrogen from wind power (2-3 times more emissions rather than 10-20 times more without CCS). The climate impact of methane emissions is significant. According to the IPCC, historical methane emissions have contributed to a 0.5°C increase in the global temperature from the pre-industrial era, and approximately 22% of current methane emissions are from the energy sector. Emissions have been on the increase – and the share from natural gas is significant. The IEA has pointed out that major cuts in methane emissions from gas production can be achieved without any extra net costs (depending on gas prices).

SSAB sets new climate standard with the production of ‘fossil-fuel free steel’

In August, SSAB announced that their multi-year project, HYBRIT, which is aiming to create a fossil-fuel free production process for steel, had successfully made its first official deliveries to its customer Volvo. The venture was announced in 2016 and has involved LKAB and Vattenfall.

The process uses electricity as an energy source and hydrogen as a reducing agent, rather than fossil fuel-based energy. This pilot is designed with a capacity of 1 ton of steel per hour. It states that the CO2 footprint will be reduced from 1.6 tons of CO2 to 25 kg CO2/ton of steel, while energy consumption will increase from 235 kWh to 3.488 kWh/ton of steel. SSAB’s plan is to scale up its production facility to enable commercial market deliveries from 2026, and SSAB is aiming to be a fossil-fuel free company by 2045. It was also recently announced that the car manufacturer Mercedes has formed a partnership with SSAB to source fossil-fuel free steel for their auto production line.

Expectations relating to the decarbonisation of steel production through the use of hydrogen have increased somewhat of late. In August, an investor group published a report to help investors accelerate decarbonisation of the steel industry by 2050. The report identifies 12 actions that investors can promote to steel producers, including transition plans for how solutions such as hydrogen and CCS will help to meet climate goals. One of the world’s biggest steel producers, ArcelorMittal, recently published its second climate action report on their ongoing work to meet their NetZero climate goal by 2050. This report states, among other things, that they expect the costs of green hydrogen to fall in future and that this will help to make hydrogen increasingly relevant to the steel industry, while also noting that CCUS will be important primarily in North America due to infrastructure access.

World’s first climate-neutral cement works planned / Unexpected challenges with supply of raw materials

In June this year, HeidelbergCement’s Swedish firm Cementa outlined its ambition to capture and store 1.8 million tons of CO2 per annum from 2030.

HeidelbergCement’s Swedish firm Cementa has spent many years working to develop technology and solutions that will allow it to become the world’s first climate-neutral cement works. This has been subject to necessary state support, infrastructure development, etc. In June this year, Cementa presented is initiative setting out the ambition to capture and store 1.8 million tons of CO2 per annum from 2030. This initiative will build on the work already carried out by Project Longship. Additionally, the company is working in partnership with Vattenfall to develop a solution to electrify cement production – CemZero. Cementa’s venture has received widespread attention internationally. However, during the summer the cement works saw its application to extract further lime from its current mines rejected by Sweden’s Land and Environment Court of Appeal. The grounds for rejection relate to the lack of scientific evidence relating to groundwater conditions in proximity to the mines. Cementa has until next summer to resolve these difficulties.

Maersk ships will run on synthetic fuels – preparing for production of green methanol

In August, Maersk announced the selection of a Danish partner for the production of 10,000 tons of green methanol per annum for use by Maersk’s eight ships due to be launched in 2023.

The ships will be capable of running both on methanol and traditional fuel. The methanol will be produced with hydrogen from renewable power and biogenic CO2. Maersk says that they hope the initiative will have a ripple effect in other companies and contribute to the more rapid decarbonisation of the industry.

The Environmental Analysis is prepared by Gassnova’s analysis team.

CCS Environmental Analysis, June and July 2021

On a monthly basis, Gassnova prepares an analysis of important CCS international market trends, and what drives innovation in our focus areas. Here is the analysis for June and July.

The EU’s “Fit for 55” – how the EU will reduce greenhouse gas emissions by 55% by 2030

In July, the Commission launched a package of proposals on how to achieve recently adopted ambitious climate targets. The package contains proposals for new and changed regulations in several areas which, according to the commission, will “transform the economy and society fundamentally”.

Some of what has been suggested:

• The quota system (ETS) is, among other things, proposed to be expanded and strengthened

• The Innovation Fund will receive more funding and expand the sectors it supports

• All new cars will be emission-free from 2035.

• Higher taxes on fossil energy used in aviation and shipping, and requirements for the use of synthetic fuels in these sectors will be gradually increased.

• The scheme covering national responsibility for policies aimed at emissions outside the quota system (ESR – “Effort Sharing Regulation”) is, as expected, to be retained and strengthened.

The ESR covers about 60% of total emissions in the EU – including sectors such as agriculture, transport and construction. Waste incineration is still retained outside the ETS. The Commission has also announced proposals for changes in the gas market, but these will not be published until the end of the year.

Dissatisfaction with the proposal for a “customs tariff mechanism”

Much attention has been paid to the proposal for a tariff mechanism (CBAM – Carbon Border Adjustment Mechanism), which will prevent the import of industrial goods produced in countries with weaker climate regulations (carbon leakage). The scheme will be introduced gradually from 2023 to 2035 and will replace the current practice that has free quotas. The Commission has proposed that the scheme initially covers these sectors: iron and steel, cement, aluminum, fertilizers and power. Several countries outside the EU have expressed strong dissatisfaction with the scheme, and it is expected that the scheme will be the subject of extensive discussions in international forums, including the WTO, before it finds its final form.

Concern for residents of countries with weaker economies

It is estimated that before it is adopted, negotiations with the relevant nation states and within the European Parliament on the proposed package may take two years or more. Some reactions have already come in. Most of the concern is related to how the changes will affect the residents of countries with weaker economies and the inability to change their consumption patterns. The Commission has therefore placed special emphasis on a “social climate fund” to meet such challenges. This includes a framework of €72 billion to be given to these countries from the EU’s own budget for the period 2025–32.

Climate concerns greatest in the northern and western parts of the EU

A recently published public survey by Eurobarometer shows that the Commission supports its priorities; for the first time, “climate change” is the single issue that the EU population ranks as humanity’s biggest challenge. Concerns about climate change are the greatest in the northern and western parts of the EU as well as in high-income groups. Concerns about the economy and access to water/food are the greatest in the southern and eastern parts of the EU.

DNV study on the prospects for a hydrogen economy: High expectations and significant barriers

In July, DNV published a study on the path to a global hydrogen economy. The study confirms significant expectations for a future hydrogen market.

Hydrogen will make up half of their economy by 2030

Among industry leaders and experts currently involved in the production and/or use of hydrogen, 26% believe that hydrogen will make up half of their economy in 2030 compared to 2% today. The study also shows that there is reasonable agreement in the expectations of producers and users of hydrogen, and that investments made today are reasonably balanced between production and consumption in order to provide security for both parties.

Lack of investment is one of the biggest barriers

The study points out that the biggest barriers are the lack of investment in infrastructure for hydrogen, the high cost levels for hydrogen and a too slow implementation of regulations and carbon prices that provide the necessary investment signals to industry leaders and experts.

The study is based on a survey of 1124 people across multiple countries, industries and professions, as well as seven in-depth interviews with industry leaders.

DNV’s analysis: 85% of hydrogen used in 2030 will be from natural gas with CCS

Although the necessity of both blue and green hydrogen seems to be accepted by the majority of those who participated in the survey, these expectations are highly subjective and depend on the geographical areas in which they operate. DNV’s own analysis suggests that 85% of hydrogen used in 2030 will be from natural gas with CCS. The results from the study indicate a far more balanced expectation of the use of blue vs green hydrogen – including among the companies involved in the development of blue hydrogen.

The first part of the Danish government’s CCS strategy is ready – government wants to store CO2 on the Danish continental shelf

In June, the government announced the first part of a new CCS strategy dealing with the transport and storage of CO2.

First part of CCS strategy: Transport and storage

The strategy facilitates both the export of Danish CO2 to other countries and the possibility of a business importing foreign CO2 to be stored on the Danish continental shelf. In June, the Danish Energy Agency also announced a tendering competition for approximately DKK 200 million for the development and demonstration of technologies that would allow for CO2 storage in the North Sea.

Second part of CCS strategy: CO2 capture

The second part of the CCS strategy will deal with where the CO2 will be captured from and will be announced later this year.

The US is trying to balance climate and economic considerations – CCS is getting more attention

Following the United States’ re-entry into the Paris Agreement and new, ambitious targets for net-zero by 2050, much has happened in the areas of energy and climate policy that may have an impact on the development of CCS in the United States.

Scheme for financing industrial CCS projects

These events have affected the scheme for financing industrial CCS projects – known as 45Q – which has now been proposed to be revised to provide increased flexibility, broader scope, a longer timeframe and – last but not least – more money. The new proposal involves payment of up to $85 per ton for CO2 captured and stored from sources such as steel and cement and $120 for Direct Air Carbon Capture and Storage (DACCS) projects. In addition, Biden’s comprehensive infrastructure plan went a step further in July. This step provides space to support new CCS infrastructure. In July, there was also a positive development in political negotiations on the draft law (SCALE act) to legitimize support for the development of infrastructure projects for CCS. This is intended for projects that fall outside the 45Q scheme.

Development in CCS-related projects among industry players

Recently, there has also been notable development of CCS-related projects among industry players. In April, for example, ExxonMobil announced plans for a giga CCS project with a hub in Houston, Texas, with the ambition of upscaling to 100 Mt CO2 stored per year by 2040. The concept will depend on public incentives, money and goodwill. More specific projects have also been announced, including projects related to LNG production and hydrogen in other industries.

Political roadmap for establishing CCS infrastructure in the United States

In July, another initiative was announced by the think tank Energy Futures Initiative (led by former Energy Minister Ernest Moniz), together with an association of trade unions, on a political roadmap for establishing CCS infrastructure in the US on a gigaton scale. In addition to the effect these measures will have on the climate the road map places great emphasis on the fact that these measures will also contribute to the preservation of jobs in industries that it is challenging to decarbonize. The media reports that the roadmap has been well received in and is being discussed in congress. Nevertheless, there are still political debates related to continued investment in fossil fuels that are taking place within the US government. Recently the US Special Envoy for Climate Change, John Kerry, reiterated the IEA’s message that we should not invest more in fossil fuel at the same time as the government approved such new projects.

UK: Britons mostly positive about CCUS, but under certain conditions

The British Ministry of Industry (BEIS) published a study in July in which the public’s attitudes and views on CCUS were analyzed.

The organization of study

The study was carried out by an independent consulting company and was based on conversations with around 100 people who live close to industrial areas in the UK where such projects are being planned. The interviewees were led through four workshops over several weeks, where various aspects of CCUS were presented by selected experts and discussed in working sessions. The company drew their conclusions of the study after both quantitative and qualitative analysis of the conducted dialogue was carried out.

Result: Interviewees support the use of CCUS under some conditions

The findings from the study were that most of the interviewees supported the use of CCUS provided that the costs could be kept under control, that the benefits were in proportion to the costs and that the solutions could be considered safe for the environment. The interviewees also emphasized the possibilities that CCUS projects led to new jobs.

CCUS – difficult to understand

In general, many participants expressed that CCUS was complex and difficult to understand. This applied to an even greater extent to CCS together with bio-energy (BECCS), while Direct Air Carbon Capture and Storage (DACCS) as a concept was perceived as more understandable even though the technology was less well tested. Regarding hydrogen, the participants expressed greater concern about the use of hydrogen, rather than the way hydrogen was produced. A small proportion of the interviewees had objections to CCUS, and their attitudes did not change after being given more information. This was mainly not about CCUS per se, but rather because CCUS contributes to prolonged dependence on fossil energy.

The Environmental Analysis is prepared by Gassnova’s analysis team.

CCS Environmental Analysis, May 2021

On a monthly basis, Gassnova prepares an analysis of important CCS international market trends, and what drives innovation in our focus areas. Here is the analysis for May.

IEA on Net Zero 2050: Enormous restructuring is ahead of us, and the road ahead is narrow

In May, the IEA published a special report on the path to net zero emissions in 2050, which is specific to the recommendations of the governments leading up to the COP26 negotiations in Glasgow in November. The report is based on previous analyses that are also mentioned in reports such as World Energy Outlook 2020. The report points out that the road ahead is narrow, and to stay on it requires the immediate and massive roll-out of all available climate technologies in the energy sector. The analyses use social aspects whereby those who lose on the transformation are compensated by those who are winners. The IEA’s analysis assumes, among other things, a global agreement on the goal, the path and the instruments, which may seem unrealistic today. The report describes more than 400 milestones across sectors and technology areas in terms of what and when. The IEA describes the challenge as enormous. Oil and gas production are projected to fall in absolute terms by 2/3 from 2020 to 2050 while oil prices will fall from $37 / barrel (2020) to $24 in 2050. Gas prices will be more stable, the IEA estimates. At the same time, the CO2 price will have to exceed US $200 in 2040 and reach US $250 in 2050 in developed economies. Annual investments needed to reach net zero emissions are estimated to have to grow from 2.5% of GDP today to 4.5% according to the IEA.

In the process industry, the IEA points to an improvement in R&D until 2030, where every month, among other things, ten large industrial plants equipped with CCUS must be built and three new hydrogen-based industrial plants built. It is also said that the greatest opportunities for innovation lie in battery technology, electrolysers and CO2 capture from the atmosphere (DACCS). The emissions in 2050 are assumed to be 1.3 Gt CO2, which must be compensated with various carbon-negative solutions. The total amount of CO2 captured by CCUS in 2050 is estimated at 7.6 Gt CO2, half of which is related to fossil energy, 20% from industrial processes and the rest from bio-CCS or DACCS. Of this, 0.5 Gt will be used for various purposes (CCU). For three areas with special criticality for meeting the climate goals, the IEA has conducted its own sensitivity analyses. This applies to the areas of ‘changed consumer behaviour’, ‘access to bioenergy’ and ‘CCUS linked to fossil energy’. The sensitivity analysis for CCUS shows that if this is not used for fossil energy, investments in renewable energy will have to be increased so that the overall investment level measured against GDP increases from 4.5% to 5%. At the same time, significant projects related to fossil energy will have to be shut down ahead of schedule.

Porthos an important step closer to investment decision

The financing of the CCS cluster project at the Port of Rotterdam has come and is a good step further after the authorities have promised to support the project with €2 billion over a period of 15 years. The project will be able to capture and store 2.5 million tonnes of CO2 per year from several ‘cheaper’ CO2 sources at refineries and hydrogen factories owned by ExxonMobil, Shell, Air Liquide and Air Products. The investment decision is expected at the turn of the year, and operations are planned from 2024. The support scheme is designed as a ‘Contract-for-Difference’ (CfD), which means that the support balances out costs against the quota price. The government’s reason for the scheme itself is that the country has so far failed to reduce its emissions in line with its international obligations, and that in 2019 the government lost a climate lawsuit in the Supreme Court and was sentenced to do more to reduce greenhouse gas emissions.

Shell lost, but is appealing case in the Netherlands: What can the case say next?

In a ruling in The Hague in May, Shell was sentenced to cut CO2 emissions, caused by its global businesses, by 45% by 2030. Shell’s total emissions, including the use of its fossil products, are about 0.7 Gt per year. Shell’s latest climate strategy states that their goal is to reduce ‘carbon intensity’ by 45% by 2035. The Dutch court ruled that this goal does not necessarily mean a reduction in CO2 emissions, and that the strategy to achieve the climate goals as a whole is not concrete enough. Shell argues that they cannot be convicted under Dutch law for emissions that other companies in other countries produce with their products and has appealed the case to the Supreme Court.

The case joins the series of small and large climate confrontations between ‘oil majors’ and society at large. For example, decisions on increased focus on climate issues were made at the general meetings of both Chevron and Exxon in May, against the boards’ wishes. And the pressure in the same forums for Shell and TotalEnergies is also increasing in terms of taking climate more seriously. In a commentary published in the Financial Times, the rhetorical question asked is whether this is an ‘omen’ for all fossil CO2 emissions. It is also pointed out that the ruling could have significant ‘consequences for Shell’s cash flow if they have to cut emissions by cutting sales of petroleum products by 3% per year. It is worth noting that their climate strategy for 2030 already states that they aim to increase their capacity within CCS by 25 Mt CO2 by 2035, as one of the means to fulfill their climate ambitions.

Deloitte / SINTEF / IFP: Significant blue hydrogen important for achieving EU climate goals

In the EU’s Green Deal, hydrogen has been highlighted as an important element for integrating various energy systems and contributing to CO2 reductions, especially in the process industry and transport. The EU’s hydrogen strategy focuses primarily on hydrogen from renewable sources and supplementing with hydrogen from fossil sources in combination with CCS. The competition between green vs. blue hydrogen is already underway, and will in future depend on political, financial, commercial and resource conditions. A new, thorough and comprehensive quantitative analysis, carried out by SINTEF and others, provides new insight into how hydrogen produced from different energy sources can contribute to the EU’s climate goals, the competitive relationship between blue and green hydrogen, and relevant cost consequences of various policy choices. The report was commissioned by players in the oil and gas industry.

The analysis’s two scenarios are both based on the EU’s new targets for net zero emissions in 2050, but with different targets for renewables in the energy mix: today’s 32% target per 2030 vs. a 40% target – increasing to 80% by 2050. The analysis covers the EU including the UK and Norway in one integrated energy system, including energy imports from other countries. The analysis concludes that a preferred energy system in the EU in 2050 means that electricity as an energy carrier will increase from 26% to just over 40%, and that the share of hydrogen in the energy mix in both scenarios will exceed 20% in 2050. The report indicates that green hydrogen will drive coal and oil almost completely out of the energy system by 2050, and that tighter renewable targets will limit demand growth for natural gas. Technologies for hydrogen production from natural gas with the lowest emissions per tonne of hydrogen come out best in the analysis. The total societal costs in the scenarios are marginally different, but the investment costs in a development phase are estimated to be somewhat higher given higher requirements for renewables. The amount of CO2 stored from hydrogen production is estimated at about 200 Mt pa. from 2030.

Germany; New momentum in the climate issue

In recent months, there has been some growing acceptance in the German political debate about the need for CCUS before 2050 to achieve tighter climate goals. In April, the German industry association BDI published a discussion note indicating that CCUS must now be considered for industries that are difficult to decarbonise, as well as for the production of hydrogen from natural gas. Also, among various think tanks and NGOs in Germany, which have traditionally expressed skepticism about the use of CCS, there are now reports of changed assessments. Among other things, Agora Energiewende published a report in May in which they present an analysis that indicates that CCS may have to be used in Germany as early as 2030 to achieve ambitious climate goals.

The debate on the German climate effort gained momentum at the end of April when the German Constitutional Court issued a somewhat surprising ruling that the German Climate Act of 2019 is partly unconstitutional. The main point of the ruling was that the government’s strategy for cutting greenhouse gases leaves too great a cost to future generations and is not concrete enough with regard to how emissions are to be cut. The government was given a deadline of the end of 2022 to come up with a revised climate law. The case was promoted by nine German youths with broad support from various NGOs. Already at the beginning of May, the government launched a revised climate plan, now with a goal of 65% cuts in greenhouse gases by 2030 and climate neutrality in 2045. In other words, significantly more ambitious than the EU’s goal of 55% by 2030. Germany has also had tighter climate goals.

Prepared by Gassnova’s analysis team.

Subscribe to CCS Newsletter

Gassnova publishes once a week a newsletter,where you will receive an overview of national and international CCS news.

If you want to receive the latest CCS news via e-mail, you can send an e-mail to postmottak@gassnova.no to let us know.

Gassnova SF makes changes to its management team

The Board of Directors and the CEO, Trude Sundset, have agreed that Trude Sundset will step down from her role managing Gassnova on a day-to-day basis effective 1 February 2021. Roy Vardheim will assume the duties of the CEO until further notice.

Following the Norwegian Parliament´s adoption of the state budget for

2021 in a vote on 14 December 2020, which had a bearing on the future plans for

project ‘Longship’, crucial elements of Gassnova’s operations are now

transitioning into a new phase.

The Board of Directors and the CEO, Trude Sundset, have agreed that Trude

Sundset will step down from her role on 1 February 2021 following a period of

five years leading the company.

‘Trude Sundset has been a visible leader and ambassador for our work to bring the CCS ‘Longship’ project to maturity ahead of the Storting’s launch. I would like to thank Trude for her efforts and for her positive dialogue as Gassnova enters into a new phase,’ says Morten Ruud, Chairman of the Gassnova Board of Directors.

‘The time is right for me to move on having guided the company through a strategic process and facilitated the reorganisation of the business ahead of its next phase. I feel privileged to have led Gassnova and its amazing team of professionals over the course of five rewarding years. We have worked well together with external stakeholders to help develop “Longship” into a project that has every opportunity to achieve its goals. I wish the entire organisation well in its work to realise project “Longship”,’ says Trude Sundset.

Roy Vardheim, 64, will serve as acting CEO of Gassnova until further notice. Vardheim has been in charge of Gassnova’s TCM department since 2017. Prior to that he was the CEO of Technology Centre Mongstad (TCM).

Vardheim has extensive experience in senior management in a series of companies, including periods as CEO of Norske Skog Saugbrug AS and Borealis. He also has international experience in the top management, including roles at Borouge in the Middle East and BIS in Scandinavia.

Vardheim serves as the Chairman on a number of Boards, including those of TCM Assets AS, Grenland Havn IKS, Skagerrak Sparebank, Frier Vest Holding AS and Grenland Havn Eiendom AS. Roy Vardheim is a Chartered Engineer specialising in Industrial Chemistry having graduated from the Norwegian Institute of Technology (now known as the Norwegian University of Science and Technology).

Gassnova is a state-owned enterprise engaged in CCS and is subject to the Norwegian Ministry of Petroleum and Energy. Read more about Gassnova here.

Contact person at Gassnova SF: Chairman Morten Ruud, tel. +47 91 15 49 56.

The Longship White Paper available in English

The report to the Storting about «Longship – Carbon capture and storage» is now available in English.

In the Government White Paper to the Norwegian parliament, submitted 21 September 2020, the Government proposes to launch the carbon capture and storage (CCS) project Longship in Norway. Longship was later approved by the Storting in December.

Studies focusing on amine components

Studies of amines, nitrosamines and nitramines and how they can occur in amine-based CO2 capture were initiated in Norway as early as 2007. Here we have collected reports from the work that has been financed through the various parts of Gassnova.

Since it became evident that amines could undergo photochemical reactions with free radicals and NOx in the atmosphere to form nitrosamines and nitramines, emissions of amines have been high on the agenda for Norwegian environmental authorities. Some nitrosamines and nitramines have shown carcinogenic effects in animal studies, thus spreading in the environment is not acceptable and should be limited.

Studies on these compounds and how they are linked to amine-based CO2-capture were initiated as early as in 2007 and results of this work co-funded through the different parts of Gassnova ca be found in the linked documentation below.

CLIMIT fundes studies

CLIMIT cofunded the first set of studies from 2008. These studies started up as literature surveys (NILU phase 1) to map available knowledge on the subject and developed further to test properties of amines with respect to formation of nitrosamines and nitramines under capture and atmospheric conditions as well as toxicity and degradation of nitrosamines and nitramines in the environment. The two reports which summarize this comprehensive work best are:

Amine emissions to air during carbon capture. Phase I: CO2 and amines screening study for effects to the environment.

Atmospheric Degradation of Amines (ADA): Summary report from atmospheric chemistry studies of amines, nitrosamines, nitramines and amides.

TCM fundes studies

Technology Centre Mongstad (TCM) were supposed to start up its test activities around 2010, a.o. amine-based CO2 capture. A discharge permit was required for both amines, nitrosamines and nitramines. Thus, the urgent work was to acquire enough information and background to get such a permit from the authorities.

Several studies were conducted to improve the understanding of the atmospheric chemistry of amines as well as the environmental faith and pathways of Nitramines and Nitrosamines. Reports from these studies are found here at TCM’s homepage.

Full-scale Mongstad (CCM) fundes studies

The full-scale Mongstad project (CCM) started up in 2009. Technologies were supposed to be qualified for CO2 capture at the CCGT plant at Mongstad and amine technology was the most mature solution.

A comprehensive work was initiated to establish a technology qualification program with the aim of documenting amine capture being a safe solution for CO2 capture. The project was terminated in 2013 but the most important results of this project – a set of more than 60 reports concerning amines, nitrosamine and nitramines – are listed on ccsnorway.com.

Publications: Based on all work carried out within this field and funded by all three branches of Gassnova several papers have been published. Here shown with two summary papers:

Gjernes, E., L.I. Helgesen, Y. Maree: «Health and Environmental impact of amine based post combustion CO2 capture”, Energy Procedia, Volume 37, 2013, page 735-742

Helgesen, L.I. and E. Gjernes: «A way of qualifying Amine Based Capture Technologies with respect to Health and Environmental Properties”, Energy Procedia, Volume 86, January 2016, page 239-251

Important milestone in the CO₂ storage project

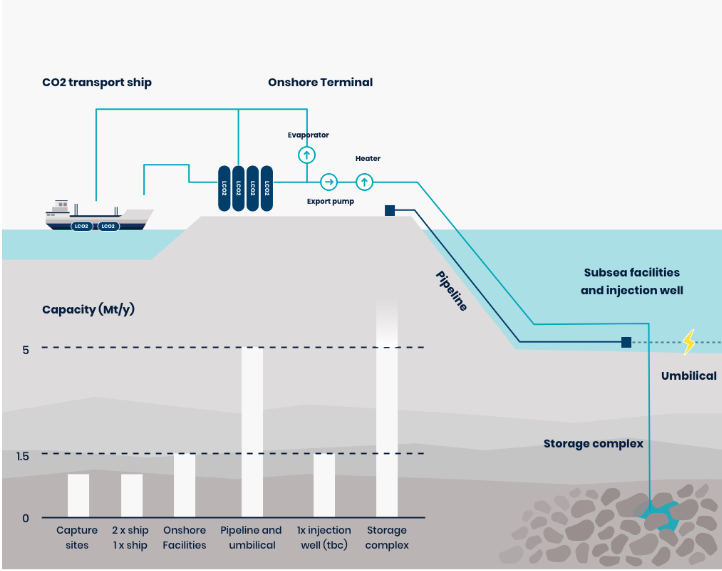

The Ministry of Energy has received and started our assessment of the development plan for the Northern Lights CO2-storage project.

A necessary step

– Carbon capture and storage (CCS) is important for achieving the goals of the Paris Agreement. The submission of the development plan is a necessary step in order to realize full-scale CO2-capture and storage in Norway. The Northern Lights project will also be able to offer CO2 storage from other countries. Northern Lights is an example of the expertise and experience we have built up in the oil and gas industry being used in the development of new technology and new solutions that ensure sustainable use of energy. Hywind Tampen, which was just approved by the authorities, is another such example, says Minister Tina Bru.

Read the full press release from the Norwegian Ministry of Petroelum and Energy here

Will have room for CO2 from all across Europe

– The Norwegian CCS project is in many ways a European project, since the planned storage facility in the North Sea will have room for CO2 from all across Europe. An important milestone for the Norwegian full-scale project has now been passed since the Northern Lights consortium has submitted their development plan to the authorities, says Gassnova’s CEO Trude Sundset.

For more information about the Norwegian Fullscale CCS Project: ccsnorway.com

For more information about the Northern Lights part of the project: northernlightsccs.com/