Germany; New momentum in the climate issue

In recent months, there has been some growing acceptance in the German political debate about the need for CCUS before 2050 to achieve tighter climate goals.

Discussion note; CCUS must be considered

In April, the German industry association BDI published a discussion note indicating that CCUS must now be considered for industries that are difficult to decarbonise, as well as for the production of hydrogen from natural gas. Also, among various think tanks and NGOs in Germany, which have traditionally expressed skepticism about the use of CCS, there are now reports of changed assessments. Among other things, Agora Energiewende published a report in May in which they present an analysis that indicates that CCS may have to be used in Germany as early as 2030 to achieve ambitious climate goals.

The German Climate Act of 2019 is partly unconstitutional

The debate on the German climate effort gained momentum at the end of April when the German Constitutional Court issued a somewhat surprising ruling that the German Climate Act of 2019 is partly unconstitutional. The main point of the ruling was that the government’s strategy for cutting greenhouse gases leaves too great a cost to future generations and is not concrete enough with regard to how emissions are to be cut. The government was given a deadline of the end of 2022 to come up with a revised climate law. The case was promoted by nine German youths with broad support from various NGOs.

German revised climate plan; 65% cuts in greenhouse gases by 2030

Already at the beginning of May, the government launched a revised climate plan, now with a goal of 65% cuts in greenhouse gases by 2030 and climate neutrality in 2045. In other words, significantly more ambitious than the EU’s goal of 55% by 2030. Germany has also had tighter climate goals.

This is part of Gassnova’s environmental analysis for May, prepared by Gassnova’s analysis team.

Read the full analysis here.

Deloitte/SINTEF/IFP: Blue hydrogen important for achieving EU climate goals

In the EU’s Green Deal, hydrogen has been highlighted as an important element for integrating various energy systems and contributing to CO2 reductions, especially in the process industry and transport. The EU’s hydrogen strategy focuses primarily on hydrogen from renewable sources and supplementing with hydrogen from fossil sources in combination with CCS.

Competition between green and blue hydrogen

The competition between green and blue hydrogen is already underway, and will in future depend on political, financial, commercial and resource conditions.

A new quantitative analysis, carried out by SINTEF and others, provides new insight into how hydrogen produced from different energy sources can contribute to the EU’s climate goals. The analysis also addresses the competitive relationship between blue and green hydrogen, and relevant cost consequences of various policy choices. The report was commissioned by players in the oil and gas industry.

The analysis’s two scenarios are both based on the EU’s new targets for net zero emissions in 2050, but with different targets for renewables in the energy mix: today’s 32% target per 2030 vs. a 40% target – increasing to 80% by 2050.

The analysis covers the EU including the UK and Norway in one integrated energy system, including energy imports from other countries. The analysis concludes that a preferred energy system in the EU in 2050 means that electricity as an energy carrier will increase from 26% to just over 40%, and that the share of hydrogen in the energy mix in both scenarios will exceed 20% in 2050.

Green hydrogen will drive coal and oil out of the energy system

The report indicates that green hydrogen will drive coal and oil almost completely out of the energy system by 2050, and that tighter renewable targets will limit demand growth for natural gas. Technologies for hydrogen production from natural gas with the lowest emissions per tonne of hydrogen come out best in the analysis. The total societal costs in the scenarios are marginally different, but the investment costs in a development phase are estimated to be somewhat higher given higher requirements for renewables. The amount of CO2 stored from hydrogen production is estimated at about 200 Mt pa. from 2030.

This is part of the Enviromental Analysis, prepared by Gassnova’s analysis team. Here you can read the analysis for May.

Porthos an important step closer to investment decision

The financing of the CCS cluster project at the Port of Rotterdam has come and is a good step further after the authorities have promised to support the project with €2 billion over a period of 15 years.

May capture and store 2.5 million tonnes of CO2 per year

The project will be able to capture and store 2.5 million tonnes of CO2 per year from several ‘cheaper’ CO2 sources at refineries and hydrogen factories owned by ExxonMobil, Shell, Air Liquide and Air Products. The investment decision is expected at the turn of the year. Operations are planned from 2024.

The support scheme is designed as a ‘Contract-for-Difference’ (CfD), which means that the support balances out costs against the quota price. The government’s reason for the scheme itself is that the country has so far failed to reduce its emissions in line with its international obligations, and that in 2019 the government lost a climate lawsuit in the Supreme Court and was sentenced to do more to reduce greenhouse gas emissions.

This is part of the CCS environmental analysis, prepared by Gassnova’s analysis team.

Read the analysis here.

Edit this text area as you want, make headings and paragraphs…

German interest in Norwegian CCS work

In the German political debate there has been an increasing focus on CCS to achieve tighter climate goals by 2050. Now German politicians will learn more about the Norwegian model for CCS, and what Norway is about to offer Europe.

Falling costs

Equinor invited Gassnova to present experiences from the Langskip project to the German ambassador to Norway, Equinor’s country manager in Germany, the Norwegian Petroleum Directorate and German politicians. The societal goal for Langskip is that a demonstration of CO2 management will provide the necessary development of CCS beyond Norway’s borders. CCS will contribute to achieving the long-term climate goals in Norway and the EU at the lowest possible cost. The head of the CCS technology and knowledge hub department in Gassnova, Audun Røsjorde, spoke about the experiences from the development and testing of technology, including the cost picture for CCS in the future. Experience from other industries and technologies shows that costs will fall over time due to upscaling and innovation.

Innovation and learning important to reduce costs

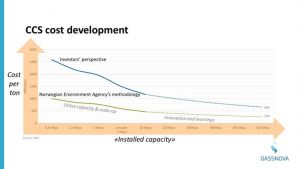

There are different ways to calculate the cost of CCS, and the figure shows two cost curves based on different assumptions. The main difference between the two curves is the expectation of return: An investor has a higher expectation than society. One axis shows cost per tonne, while the other shows ‘installed capacity’ (total capacity in the world). The figures are based on the ‘Longship’ project, and the starting point for the baskets is the cost per tonne for the Longship CCS chain from day one.

Since the receiving terminal handles more CO2 than Heidelberg Materials and possibly Fortum can capture and deliver, the first step will be to utilise the extra capacity. This will reduce costs per tonne. Similarly, the pipeline also has a higher capacity than the rest of the value chain, and an expansion with, among other things, more ships and wells will further reduce the cost per tonne. The costs per tonne will fall more if larger capture facilities are included in the value chain. In the initial phase, the cost per tonne will therefore decrease due to better capacity utilisation and upscaling. To bring costs down further, innovation and learning will play a more important role (shown by the dotted sections of the curves). See the report that discusses this cost development curve here. The report was prepared in connection with the socio-economic analysis (Appendix 4).

CCS in Germany

In April, the German industry association BDI published a discussion note indicating that CCUS must now be considered for industries that are difficult to decarbonise, as well as for the production of hydrogen from natural gas. Also, among various think tanks and NGOs in Germany, which have traditionally expressed skepticism about the use of CCS, there are now reports of changed assessments. Among other things, Agora Energiewende published a report in May in which they present an analysis that indicates that CCS may have to be used in Germany as early as 2030 to achieve ambitious climate goals.

You will find more detail about CCS in Germany in our environmental analysis.

Edit this text area as you want, make headings and paragraphs…

CCS Environmental Analysis, May 2021

On a monthly basis, Gassnova prepares an analysis of important CCS international market trends, and what drives innovation in our focus areas. Here is the analysis for May.

IEA on Net Zero 2050: Enormous restructuring is ahead of us, and the road ahead is narrow

In May, the IEA published a special report on the path to net zero emissions in 2050, which is specific to the recommendations of the governments leading up to the COP26 negotiations in Glasgow in November. The report is based on previous analyses that are also mentioned in reports such as World Energy Outlook 2020. The report points out that the road ahead is narrow, and to stay on it requires the immediate and massive roll-out of all available climate technologies in the energy sector. The analyses use social aspects whereby those who lose on the transformation are compensated by those who are winners. The IEA’s analysis assumes, among other things, a global agreement on the goal, the path and the instruments, which may seem unrealistic today. The report describes more than 400 milestones across sectors and technology areas in terms of what and when. The IEA describes the challenge as enormous. Oil and gas production are projected to fall in absolute terms by 2/3 from 2020 to 2050 while oil prices will fall from $37 / barrel (2020) to $24 in 2050. Gas prices will be more stable, the IEA estimates. At the same time, the CO2 price will have to exceed US $200 in 2040 and reach US $250 in 2050 in developed economies. Annual investments needed to reach net zero emissions are estimated to have to grow from 2.5% of GDP today to 4.5% according to the IEA.

In the process industry, the IEA points to an improvement in R&D until 2030, where every month, among other things, ten large industrial plants equipped with CCUS must be built and three new hydrogen-based industrial plants built. It is also said that the greatest opportunities for innovation lie in battery technology, electrolysers and CO2 capture from the atmosphere (DACCS). The emissions in 2050 are assumed to be 1.3 Gt CO2, which must be compensated with various carbon-negative solutions. The total amount of CO2 captured by CCUS in 2050 is estimated at 7.6 Gt CO2, half of which is related to fossil energy, 20% from industrial processes and the rest from bio-CCS or DACCS. Of this, 0.5 Gt will be used for various purposes (CCU). For three areas with special criticality for meeting the climate goals, the IEA has conducted its own sensitivity analyses. This applies to the areas of ‘changed consumer behaviour’, ‘access to bioenergy’ and ‘CCUS linked to fossil energy’. The sensitivity analysis for CCUS shows that if this is not used for fossil energy, investments in renewable energy will have to be increased so that the overall investment level measured against GDP increases from 4.5% to 5%. At the same time, significant projects related to fossil energy will have to be shut down ahead of schedule.

Porthos an important step closer to investment decision

The financing of the CCS cluster project at the Port of Rotterdam has come and is a good step further after the authorities have promised to support the project with €2 billion over a period of 15 years. The project will be able to capture and store 2.5 million tonnes of CO2 per year from several ‘cheaper’ CO2 sources at refineries and hydrogen factories owned by ExxonMobil, Shell, Air Liquide and Air Products. The investment decision is expected at the turn of the year, and operations are planned from 2024. The support scheme is designed as a ‘Contract-for-Difference’ (CfD), which means that the support balances out costs against the quota price. The government’s reason for the scheme itself is that the country has so far failed to reduce its emissions in line with its international obligations, and that in 2019 the government lost a climate lawsuit in the Supreme Court and was sentenced to do more to reduce greenhouse gas emissions.

Shell lost, but is appealing case in the Netherlands: What can the case say next?

In a ruling in The Hague in May, Shell was sentenced to cut CO2 emissions, caused by its global businesses, by 45% by 2030. Shell’s total emissions, including the use of its fossil products, are about 0.7 Gt per year. Shell’s latest climate strategy states that their goal is to reduce ‘carbon intensity’ by 45% by 2035. The Dutch court ruled that this goal does not necessarily mean a reduction in CO2 emissions, and that the strategy to achieve the climate goals as a whole is not concrete enough. Shell argues that they cannot be convicted under Dutch law for emissions that other companies in other countries produce with their products and has appealed the case to the Supreme Court.

The case joins the series of small and large climate confrontations between ‘oil majors’ and society at large. For example, decisions on increased focus on climate issues were made at the general meetings of both Chevron and Exxon in May, against the boards’ wishes. And the pressure in the same forums for Shell and TotalEnergies is also increasing in terms of taking climate more seriously. In a commentary published in the Financial Times, the rhetorical question asked is whether this is an ‘omen’ for all fossil CO2 emissions. It is also pointed out that the ruling could have significant ‘consequences for Shell’s cash flow if they have to cut emissions by cutting sales of petroleum products by 3% per year. It is worth noting that their climate strategy for 2030 already states that they aim to increase their capacity within CCS by 25 Mt CO2 by 2035, as one of the means to fulfill their climate ambitions.

Deloitte / SINTEF / IFP: Significant blue hydrogen important for achieving EU climate goals

In the EU’s Green Deal, hydrogen has been highlighted as an important element for integrating various energy systems and contributing to CO2 reductions, especially in the process industry and transport. The EU’s hydrogen strategy focuses primarily on hydrogen from renewable sources and supplementing with hydrogen from fossil sources in combination with CCS. The competition between green vs. blue hydrogen is already underway, and will in future depend on political, financial, commercial and resource conditions. A new, thorough and comprehensive quantitative analysis, carried out by SINTEF and others, provides new insight into how hydrogen produced from different energy sources can contribute to the EU’s climate goals, the competitive relationship between blue and green hydrogen, and relevant cost consequences of various policy choices. The report was commissioned by players in the oil and gas industry.

The analysis’s two scenarios are both based on the EU’s new targets for net zero emissions in 2050, but with different targets for renewables in the energy mix: today’s 32% target per 2030 vs. a 40% target – increasing to 80% by 2050. The analysis covers the EU including the UK and Norway in one integrated energy system, including energy imports from other countries. The analysis concludes that a preferred energy system in the EU in 2050 means that electricity as an energy carrier will increase from 26% to just over 40%, and that the share of hydrogen in the energy mix in both scenarios will exceed 20% in 2050. The report indicates that green hydrogen will drive coal and oil almost completely out of the energy system by 2050, and that tighter renewable targets will limit demand growth for natural gas. Technologies for hydrogen production from natural gas with the lowest emissions per tonne of hydrogen come out best in the analysis. The total societal costs in the scenarios are marginally different, but the investment costs in a development phase are estimated to be somewhat higher given higher requirements for renewables. The amount of CO2 stored from hydrogen production is estimated at about 200 Mt pa. from 2030.

Germany; New momentum in the climate issue

In recent months, there has been some growing acceptance in the German political debate about the need for CCUS before 2050 to achieve tighter climate goals. In April, the German industry association BDI published a discussion note indicating that CCUS must now be considered for industries that are difficult to decarbonise, as well as for the production of hydrogen from natural gas. Also, among various think tanks and NGOs in Germany, which have traditionally expressed skepticism about the use of CCS, there are now reports of changed assessments. Among other things, Agora Energiewende published a report in May in which they present an analysis that indicates that CCS may have to be used in Germany as early as 2030 to achieve ambitious climate goals.

The debate on the German climate effort gained momentum at the end of April when the German Constitutional Court issued a somewhat surprising ruling that the German Climate Act of 2019 is partly unconstitutional. The main point of the ruling was that the government’s strategy for cutting greenhouse gases leaves too great a cost to future generations and is not concrete enough with regard to how emissions are to be cut. The government was given a deadline of the end of 2022 to come up with a revised climate law. The case was promoted by nine German youths with broad support from various NGOs. Already at the beginning of May, the government launched a revised climate plan, now with a goal of 65% cuts in greenhouse gases by 2030 and climate neutrality in 2045. In other words, significantly more ambitious than the EU’s goal of 55% by 2030. Germany has also had tighter climate goals.

Prepared by Gassnova’s analysis team.

IEA: Enormous restructuring is ahead of us, and the road ahead is narrow

In May, the IEA issued a special report on the path to net zero emissions in 2050. The report is specific to recommendations to governments up to the COP26 negotiations in Glasgow in November. It is based on previous analyzes that are also mentioned in reports such as World Energy Outlook 2020. The report indicates that the road ahead is narrow.

Immediate deployment of available climate technologies is required

In May, the IEA published a special report on the path to net zero emissions in 2050, which is specific to the recommendations of the governments leading up to the COP26 negotiations in Glasgow in November. The report is based on previous analyses that are also mentioned in reports such as World Energy Outlook 2020. The report points out that the road ahead is narrow, and to stay on it requires the immediate and massive roll-out of all available climate technologies in the energy sector. The analyses use social aspects whereby those who lose on the transformation are compensated by those who are winners. The IEA’s analysis assumes, among other things, a global agreement on the goal, the path and the instruments, which may seem unrealistic today.

The report describes more than 400 milestones across sectors and technology areas in terms of what and when. The IEA describes the challenge as enormous. Oil and gas production are projected to fall in absolute terms by 2/3 from 2020 to 2050 while oil prices will fall from $37 / barrel (2020) to $24 in 2050. Gas prices will be more stable, the IEA estimates. At the same time, the CO2 price will have to exceed US $200 in 2040 and reach US $250 in 2050 in developed economies. Annual investments needed to reach net zero emissions are estimated to have to grow from 2.5% of GDP today to 4.5% according to the IEA.

Greatest opportunity for innovation in battery technology, electrolysers and DACCS

In the process industry, the IEA points to an improvement in R&D until 2030, where every month, among other things, ten large industrial plants equipped with CCUS must be built and three new hydrogen-based industrial plants built. It is also said that the greatest opportunities for innovation lie in battery technology, electrolysers and CO2 capture from the atmosphere (DACCS).

The emissions in 2050 are assumed to be 1.3 Gt CO2, which must be compensated with various carbon-negative solutions. The total amount of CO2 captured by CCUS in 2050 is estimated at 7.6 Gt CO2, half of which is related to fossil energy, 20% from industrial processes and the rest from bio-CCS or DACCS. Of this, 0.5 Gt will be used for various purposes (CCU). For three areas with special criticality for meeting the climate goals, the IEA has conducted its own sensitivity analyses. This applies to the areas of ‘changed consumer behaviour’, ‘access to bioenergy’ and ‘CCUS linked to fossil energy’.

The sensitivity analysis for CCUS shows that if this is not used for fossil energy, investments in renewable energy will have to be increased so that the overall investment level measured against GDP increases from 4.5% to 5%. At the same time, significant projects related to fossil energy will have to be shut down ahead of schedule.

Prepared by Gassnova’s analysis team.

Did you miss the presentations from Mission Innovation?

The side event about Longship and Accelerating CCS Technologies (ACT) are now published on Youtube. See all, or parts, of the event here.

The Ministry of Energy, the Research Council and Gassnova collaborated to create a side event under Mission Innovation. Here, experiences from Langskip and the international research collaboration that takes place through Accelerating CCS Technologies (ACT) were presented.

Shared knowledge about Longskip

Mission Innovation is an initiative that aims to promote cooperation between countries to develop solutions to achieve the climate goals. Authorities, industry and research communities are participating at the conference, which took place digitally this year. This is a way to share knowledge about Longskip and the Northern European cooperation on the development of CCS as a climate measure. To inspire others, not only in Europe – but also the rest of the world.

Greetings from Norway’s Minster of Energy

Norway’s Minster of Energy, Tina Bru, opened the event with a greeting. Then there were presentations of the Longship project, Northern Lights, the CCS project in Brevik and Fortum Varme’s CCS project – followed by a panel discussion. This was attended by the head of the CCUS department at IEA and the CEO of Heidelberg Northern Europe, VP Global CCS Solutions in Equinor and the Director of Business Development, Global Hydrogen & CCUS Solutions in Air Products.

HeidelbergCement starts CO₂ capture project in Sweden

The HeidelbergCement Group’s Swedish subsidiary Cementa starts planning a carbon capture plant on Gotland. The project is based, among other things, on the experiences gained through Heidelberg Materials’s carbon capture project in Brevik.

The goal of Langskip, which Heidelberg Materials’s carbon capture project is part of, is to pave the way for CCS in Europe. Today, HeidelbergCement announce that they will capture CO2 on Gotland. As much as 1.8 million tonnes of CO2 will be captured. In comparison, 400,000 tonnes will be caught in Brevik.

Sharing our experiences with Sweden

One of Gassnova’s main goals is to promote technology development and competence building for cost-effective and future-oriented solutions for CO2 management. Today, the head of CCS’s technology and knowledge hub in Gassnova, Audun Røsjorde, presented the “Lessons learned” report from the Longship project to Swedish actors.

Edit this text area as you want, make headings and paragraphs…

Gassnova’s presentation was a brief status from Longship, and our experiences from the design of «CO2 export terminals» in Longship. That means what is required to hand over CO2 from Heidelberg Materials and Fortum Oslo Varme to a ship.

The occasion is a workshop in the Swedish project “Roadmap for bio-CCS in the district heating sector in Sweden” where Profu, Chalmers, IVL Swedish Environmental Institute, Linköping University and RISE work together. There were participants from both Swedish industry, research environments and authorities («Energistyrelsen»).

Do you want to know more about our experiences with CCS?

Read more in the Lessons learned report or contact us.

Join our webinar during Mission Innovation!

Want to learn more about the largest climate project in Norwegian industry ever called “Longship”? And about Accelerating CCS Technologies (ACT) that promote CCUS through transnational funding? Join this webinar on June 1st.

The webinar will be held on June 1st at 10:50 – 12:20 (CEST), and is part of Mission Innovation.

Sign up here! (free to join)

The event is a collaboration between the U.S. Department of Energy, Ministry of Energy, Research Council of Norway, ACT and Gassnova.

Briefly about Longship:

Longship is the Norwegian state’s project for CO2 handling which includes capture, transport and storage of CO2. The project will contribute to the world reaching the climate goals, and at the same time create jobs and industry in Norway.

Briefly about ACT:

The ambition of ACT is to facilitate the emergence of CCUS via transnational funding aimed at accelerating and maturing CCUS technology through targeted innovation and research activities.